Enabling and empowering Islamic Banking, with a Sharia-compliant solution that is easy-to-use and feature-rich. Islamic Banking solution provides a range of modules that allow for simple and systematic workflows while being fully in accordance with the Shariah laws and regulations.

We make Islamic banking possible by:

- Integrating with Islamic Banking products for specific customers

- Enhancing end-to-end functionality of banking verticals

- Providing regulations and policies that are governed by the Sharia and supporting AAIOFI standard of accounting

KEY FEATURES

i.e. freedom from interest (Riba), freedom from excessive uncertainty (Gharar) and freedom from gambling (Maysir)

Can be seamlessly integrated with existing systems with

simple enhancements

- Rich accounting module with all features so Banks can use as the primary accounting system and reporting for their central banks

- Fixed Asset module that can cater to all fixed assets inventory management needs

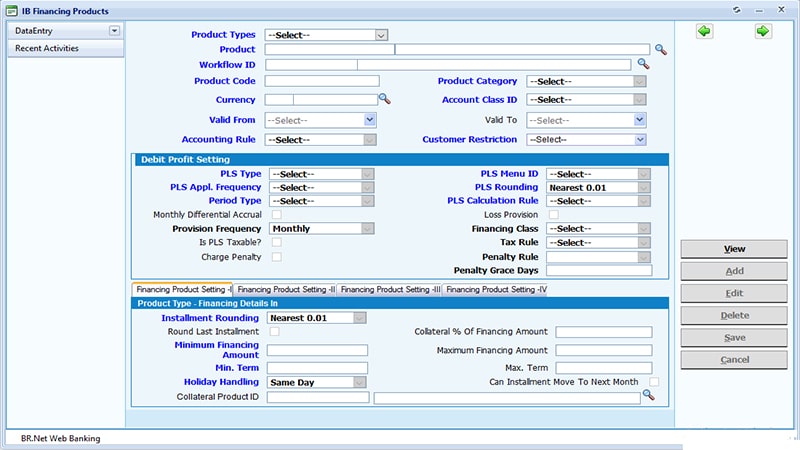

- Variety of financing contracts possible – Murabaha, Ijara, Mudaraba and Treasury

key benefits

Ethical based banking complaint to Shariah

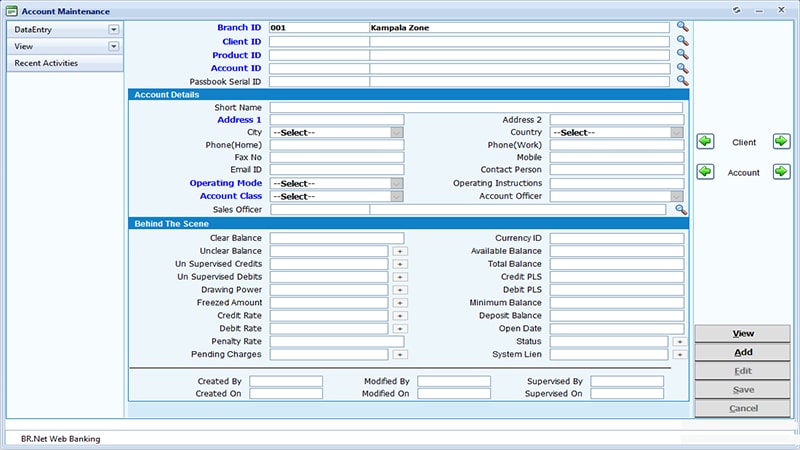

Simplified KYC process with easy third-party integration

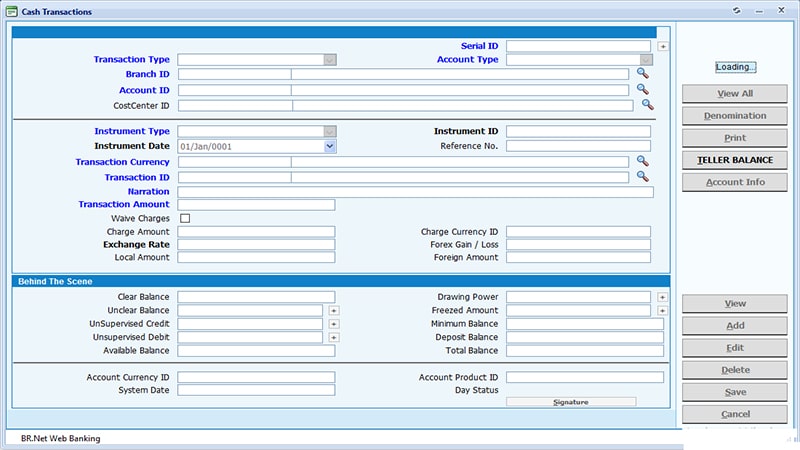

Supports multiple currencies and multiple payment methods

Improved risk management

Easy to add products and services under Shariah-based policies

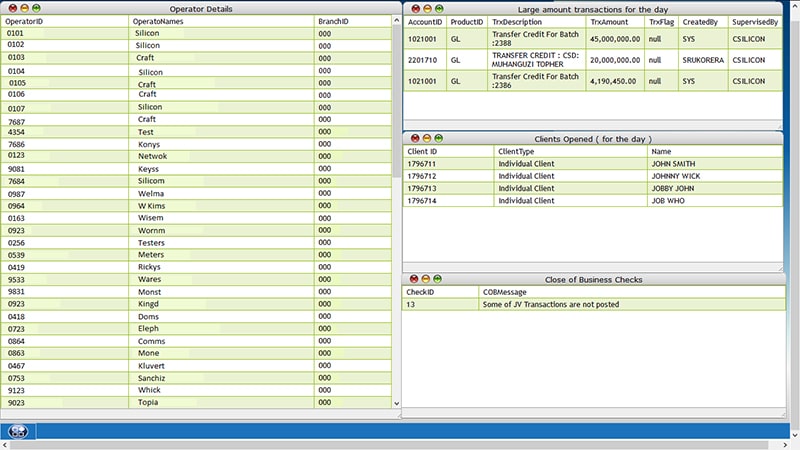

Financial Institutions can issue financial positions at the end of the day in any branch

Highly flexible in profit distribution process

Easy integration with Sharia-based utilities for funds, remittances and customised reports

Available 24*7*365 days and facilitates anywhere, anytime banking

clients

We have been using Bankers Realm Core Banking System, since 2007. We are highly satisfied by the solutions and services of the software. Despite the complex nature of microfinance operation together with the insufficient infrastructure in the region, Craft Silicon succeeded in customizing the Bankers Realm Core Banking System without showing any sign of hesitation. It also manifested its professional training and information handover to our MIS team.