With the rapid proliferation of digital channels, cybercrimes, especially money laundering, have seen a marked increase. Anti-Money Laundering (AML) software empowers banks with adequate controls to red-flag security issues and meet prudential guidelines required by Governments of banking transactions.

‘Better safe than sorry’ approach works in money laundering matters

- Automated detection and reporting of suspicious activities

- Reduces financial risk and institutional risk

- Robust features like rule-based transaction monitoring, case management, name screening and risk buckets

key featureS

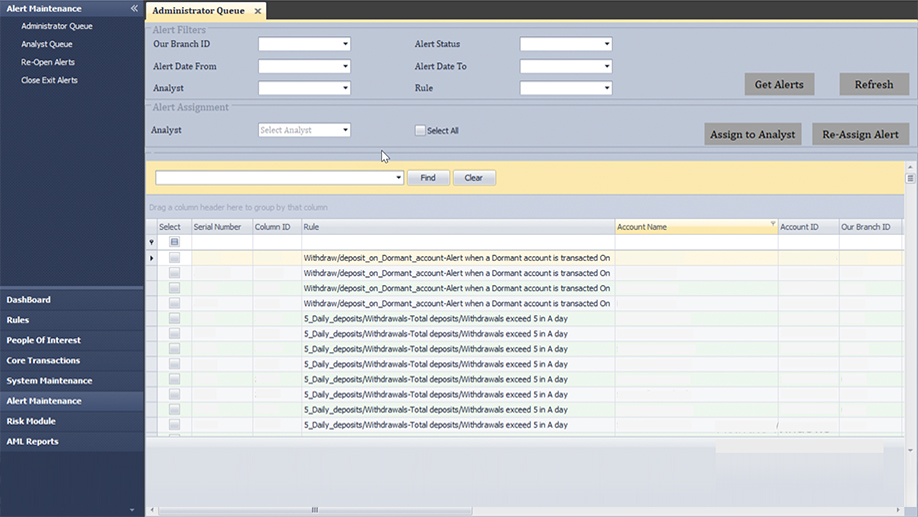

Effectively monitors real-time and batch transactions, ad hoc on-demand rule executions, scheduled rules execution with provision to set up real-time email alerts for high-risk rules.

End-to-end cycle maintenance and provision to automate resource/analyst assignation and analysis of cases flagged.

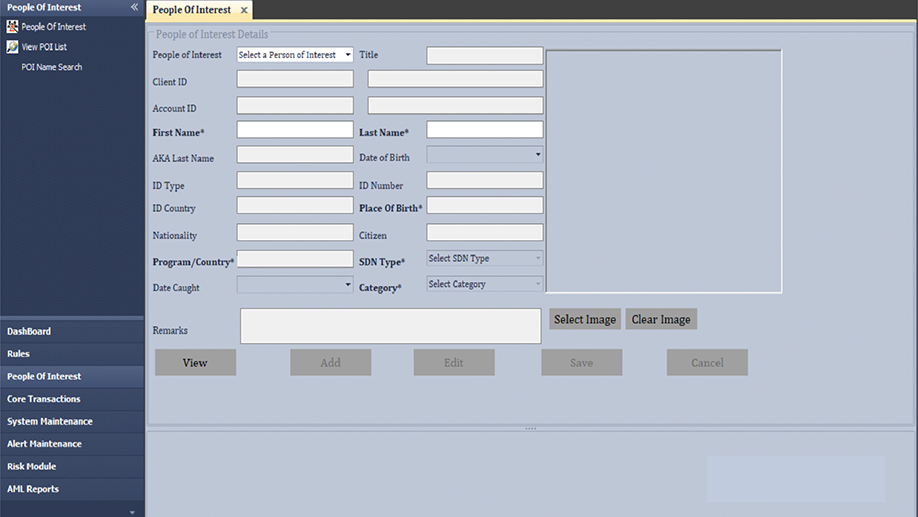

Automatic name screening of customer on-boarding against maintained lists, ad hoc name screening against watchlists, maintenance of international watchlists such as OFAC, UN, EU, HMS list, PEP list and internal bank lists.

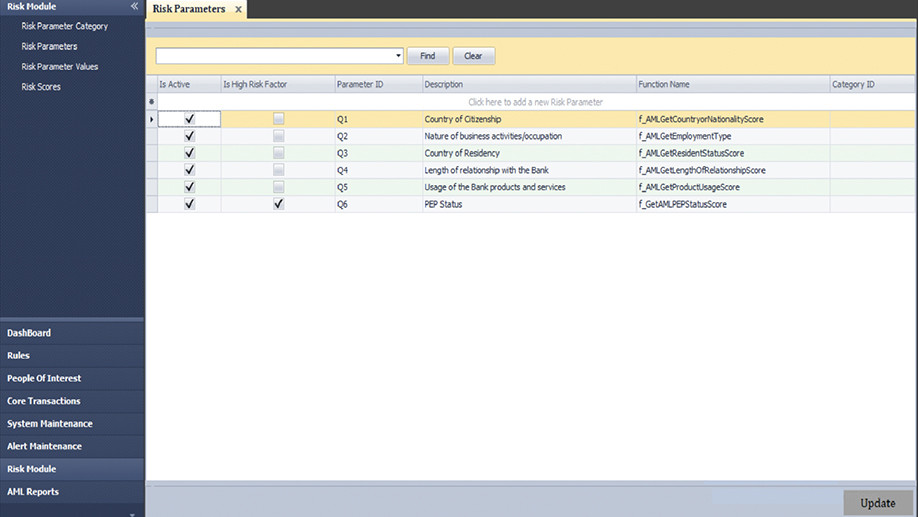

User can define risk parameters and its weightage per factor and also categorise accounts & customers at the time of on-boarding. Flexibility to override system risk scores and review and re-categorise periodically.

key benefits

Stay in control of cyberspace

System can detect and report suspicious activities

Automated name screening and email/system alert mechanism

Account activity monitoring right from the account opening stage

Multiple report export formats such as PDF, Excel, Word, CSV, Text

clients

Case Study

The objective was to streamline digital channels into a single secure experience, enable customers to open accounts instantly, and reduce the pressure on branches to service customers.

Client Speak

testimonials

Craft Silicon has been the Technology Partner for Finance Trust Bank since 2013, providing intuitive innovations in the bank's various processes, including but not limited to Core Banking, Treasury, Trade Finance, AML, Mobile & Internet Banking.

For more than 5 years, Paramount Bank has worked with Craft Silicon to implement the most innovative ways to help with the banks day to day running and to help with efficient and effective ways for our customers to bank digitally. With this Craft Silicon has provided a full suite web based core banking system and channels system to cater for both retail and corporate customers. We are satisfied with the continued support accorded by Craft Silicon to ensure smooth business operations.