MSMEs are vital to India’s growth, providing employment opportunities and contributing to rural and urban industrialization, but they often find it difficult to obtain credit due to various issues such as lack of collateral, credit history, financial literacy, delays in manual processes and lower operational efficiency, etc. The Nimble Business Loan solution is specifically designed to meet these challenges and make credit more accessible, transparent, inclusive and digitalized.

Thanks to cutting-edge technology and the best features, Nimble Business Loan technology solutions offer :

- Cost-effective systems with enhanced regulatory compliance and improved risk management.

- Paperless processing with activity tracking and audit trails.

- A seamless customer experience thanks to streamlined operations, reduced risk and increased efficiency.

- Simple loan application procedures, convenient monitoring of application status and timely disbursements.

MAIN FEATURES

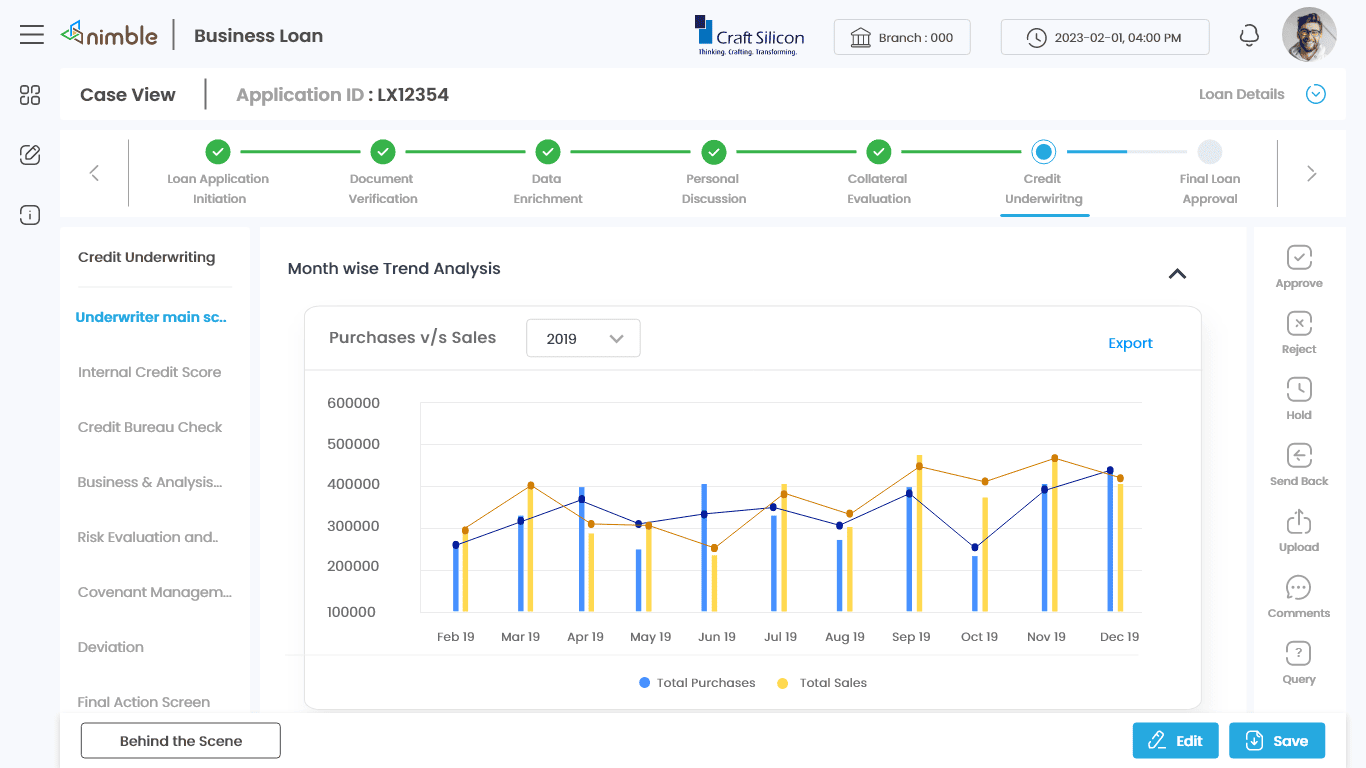

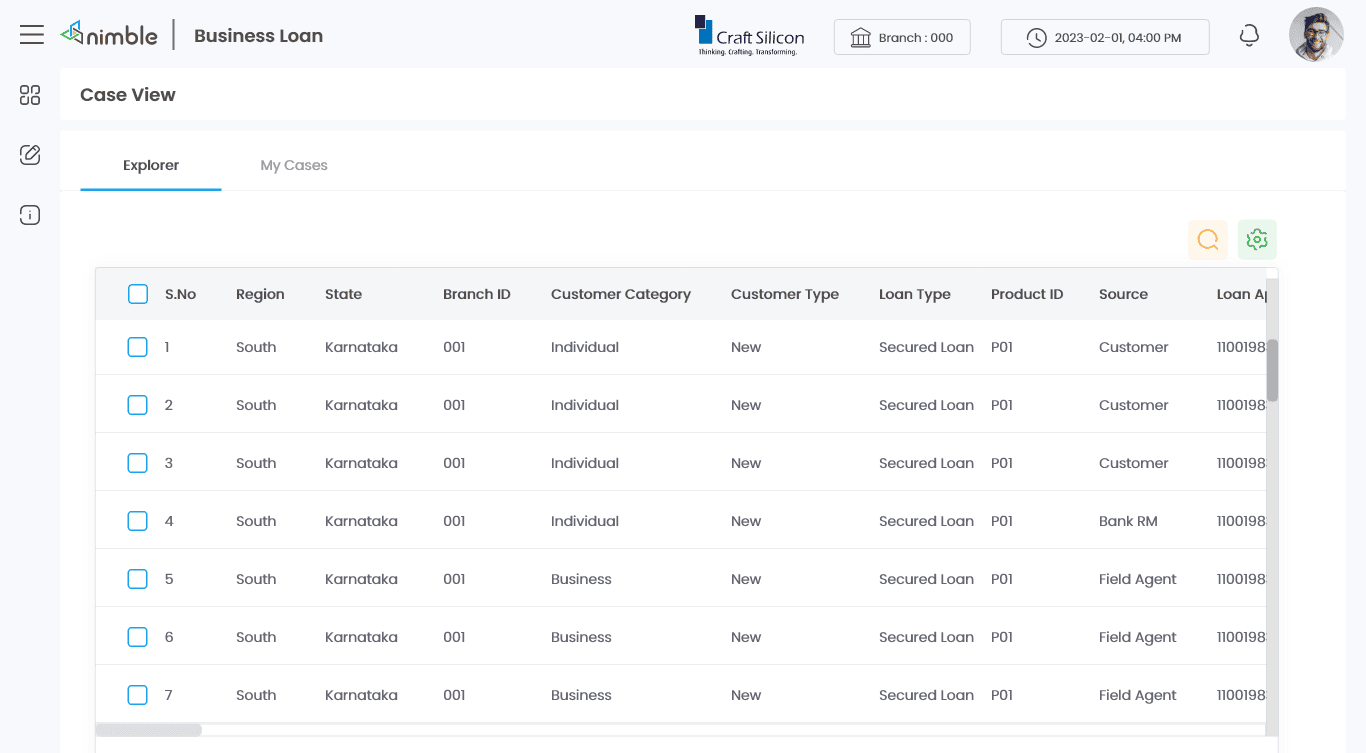

Nimble Business Loan Solution is an automated LOS platform designed to manage the complex process of evaluating proposals for the lending needs of businesses and SMEs. Our robust banking software understands the complex needs of different lending institutions. Key features include

- Modular architecture

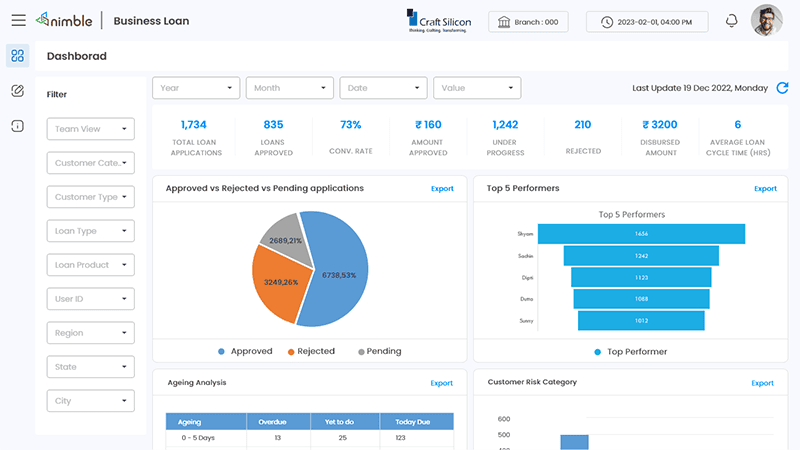

- Configurable workflows with dynamic dashboards

- Engine integrating management rules

- Gap management

- Credit committee approval

- Management of service level agreements (SLAs) and turnaround times (TATs)

KEY BENEFITS

The right technology for the success of your EMF

Verification of Udyam registration

Paperless loan processing

Activity tracking and audit trail

Highly customized to customer needs

Seamless integration of third-party applications

TESTIMONIAL

- Customer application,

- The application for field agents and

- The Web application