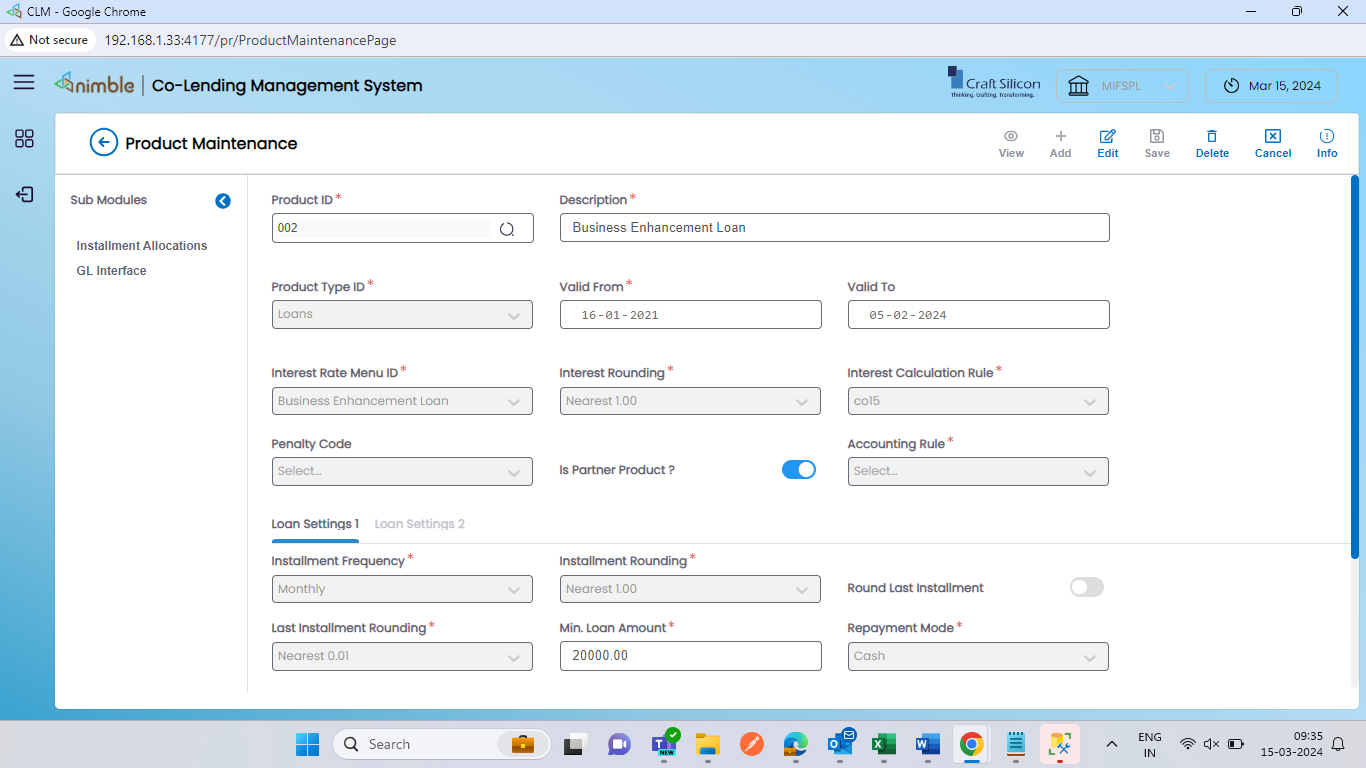

Co-financing or joint lending is a collaborative lending model in which two financial institutions jointly provide financing to borrowers. This approach enables partners to share risks and resources, leading to more diversified loan portfolios and better access to credit for borrowers.

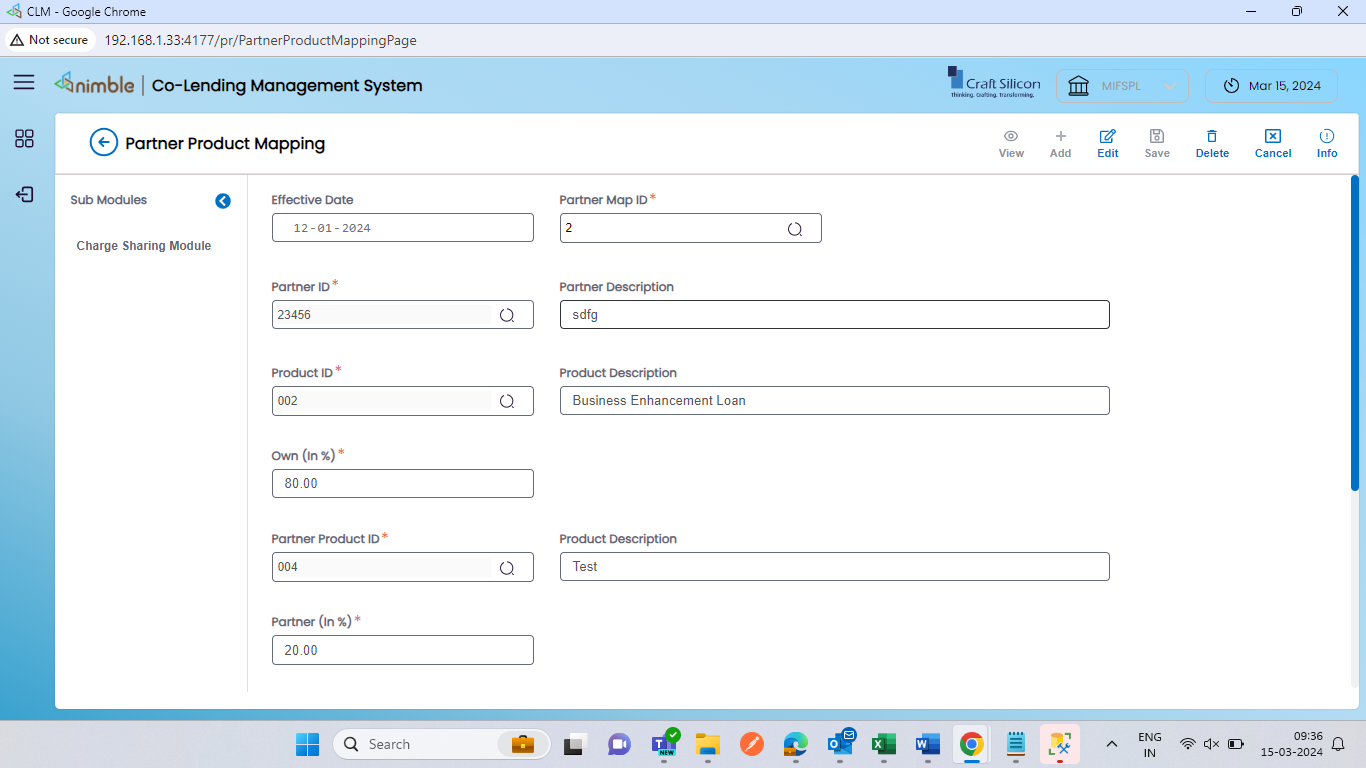

Co-financing or joint lending arrangements are often set up to leverage the strengths and resources of each lender, enabling them to reach a wider customer base, share credit risk and comply with regulatory requirements. There are two co-financing models: CLM 1 and CLM 2, each with distinct disbursement and repayment mechanisms.

MAIN FEATURES

Système indépendant pour gérer le processus de cofinancement, de la demande au décaissement et à l’encaissement.

Collaborez avec des données provenant de différents systèmes sources et gérez efficacement les demandes de prêt.

Décision CB, souscription de crédit et règles de gestion spécifiques pour une évaluation efficace de la demande de prêt.

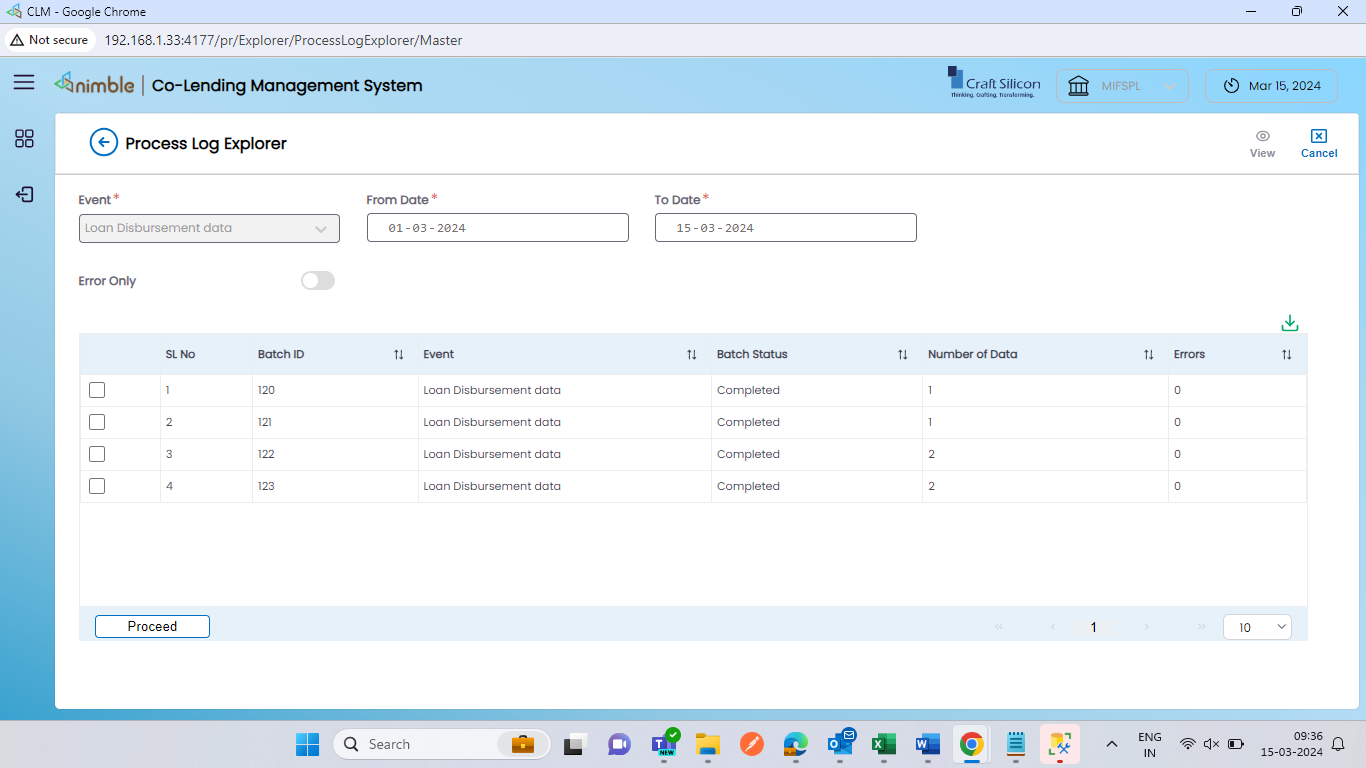

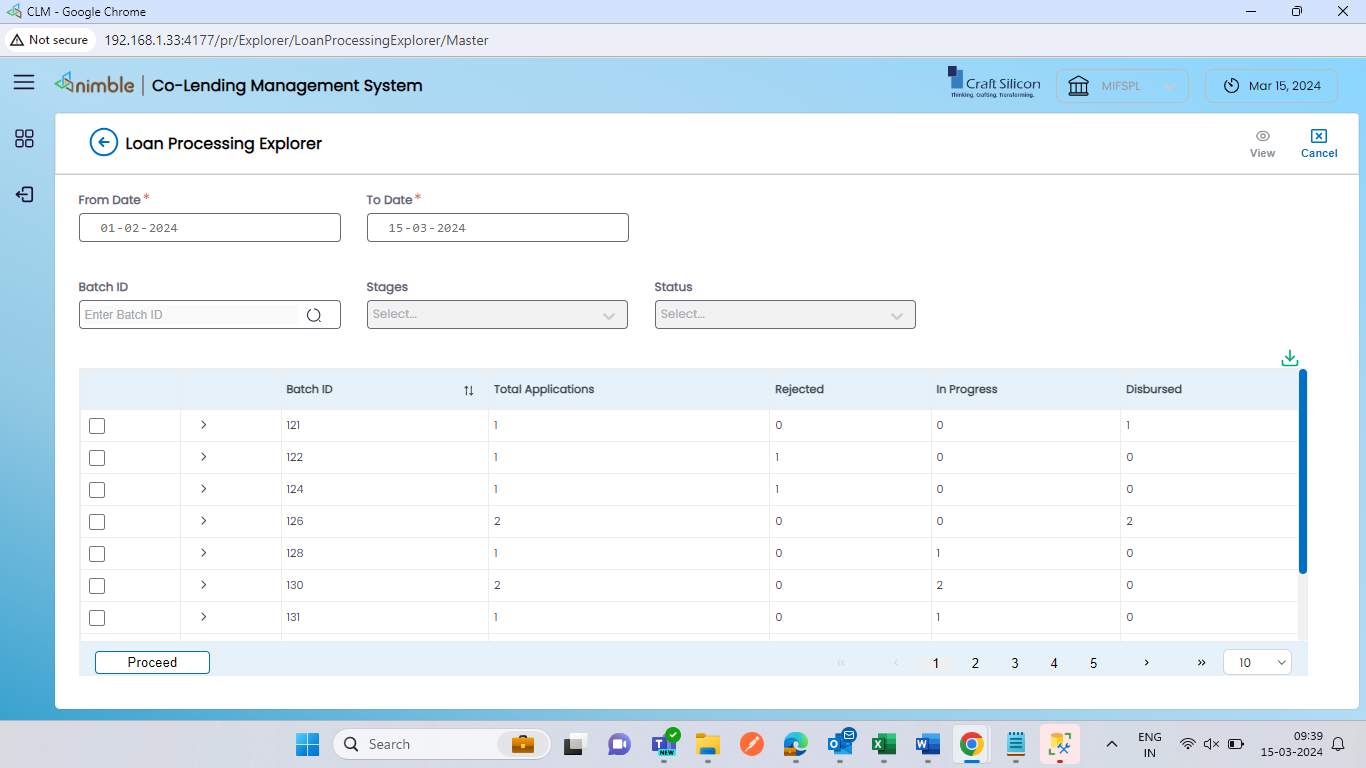

Permet le suivi et le reporting des décaissements et des encaissements, catégorisés par les banques et les NBFC.

Faciliter l’échange de données entre les différents acteurs du processus de cofinancement.

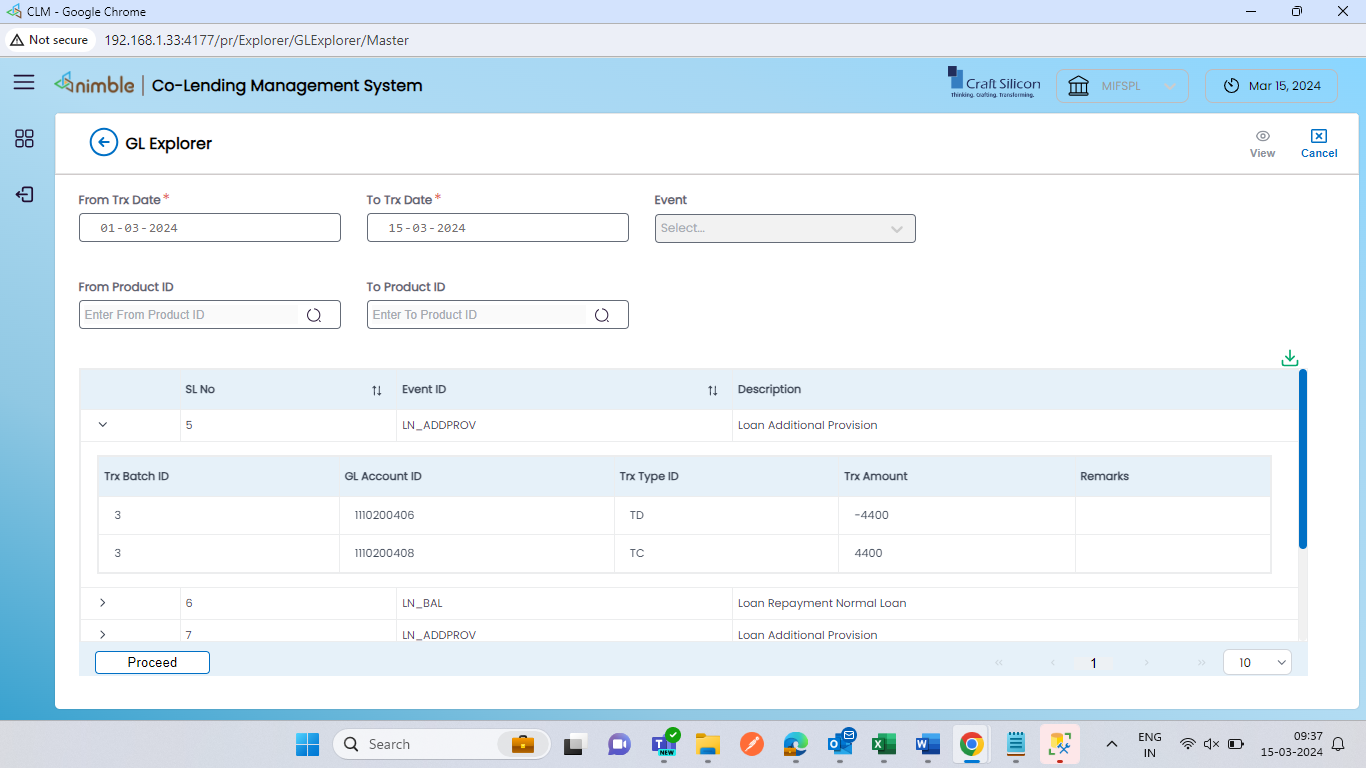

Transaction visant à gérer le solde du portefeuille des partenaires afin d’annuler le portefeuille à 100 %.

KEY BENEFITS

Contribute to the success of your lending institutions with the right technology.

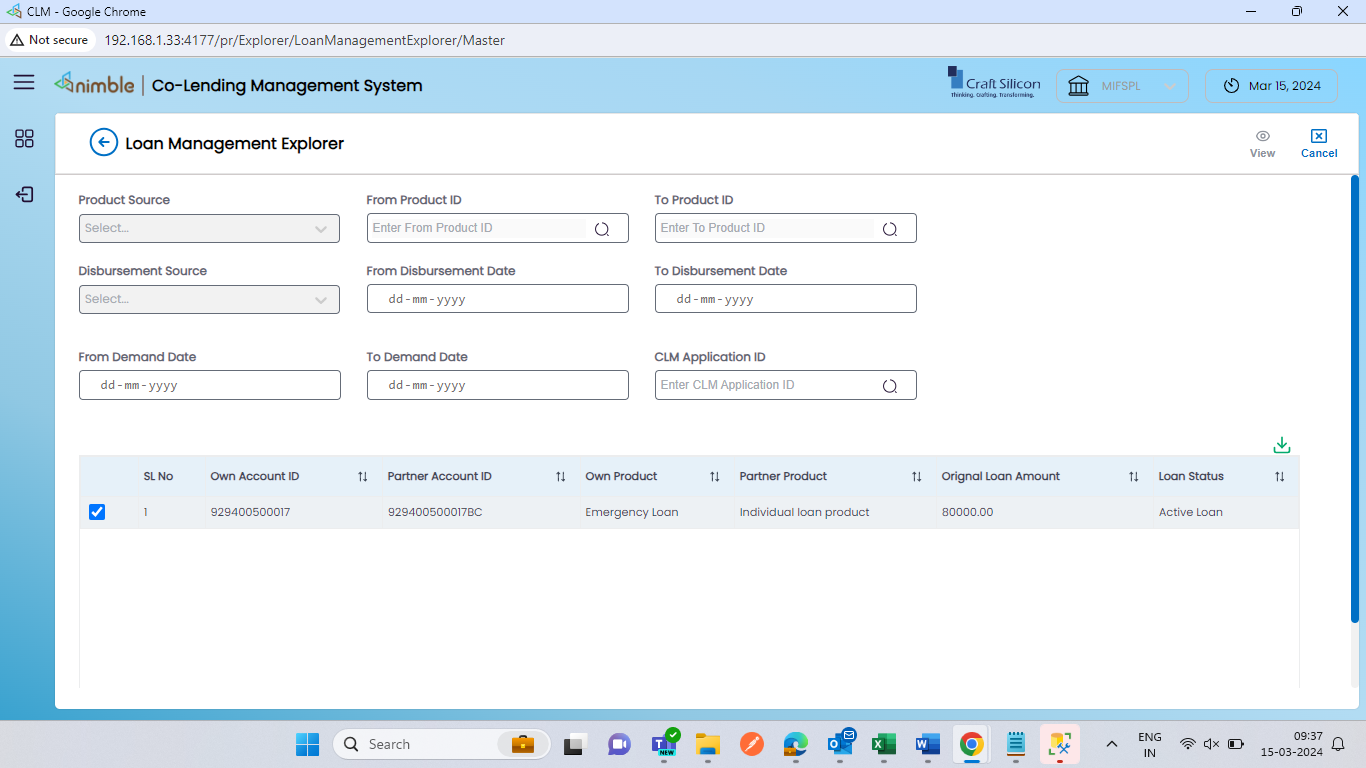

Dynamic view of loan repayment schedule (Bank, NBFC and customer schedules)

Automated distribution of disbursements and receipts with accounting entries.

API and FTP-based integrations to support real-time transactions.

Support for CLM1 and CLM2 models.

Manage multiple co-lending partnerships in a single solution.

Dynamic reporting capabilities.

customers

CASE STUDY

Craft Silicon has been with Ujjivan since its inception and has been its growth partner throughout.

CUSTOMERS SPEAK OUT

The reason we opted for BR.Net was threefold: accessibility to branches, better customer service and scalability.