The Nimble Open API Core Banking Platform is an advanced, API-driven solution designed to transform banking operations in the digital era. This platform offers a robust and flexible architecture, allowing financial institutions to seamlessly integrate with third-party services and applications. Nimble’s Open API framework ensures adaptability, scalability, and enhanced user experiences, meeting the demands of modern banking.

key features

- Comprehensive API Suite: Enables seamless integration with external systems and third-party applications.

- Modular HTTP Requests: Optimized for high transaction volumes, ensuring efficient performance.

- Built-in Dependency Injection: Simplifies development, maintenance, and scalability.

- High-Performance Platform: Developed on Microsoft ASP.Net Core 2.2 for reliable and fast operations.

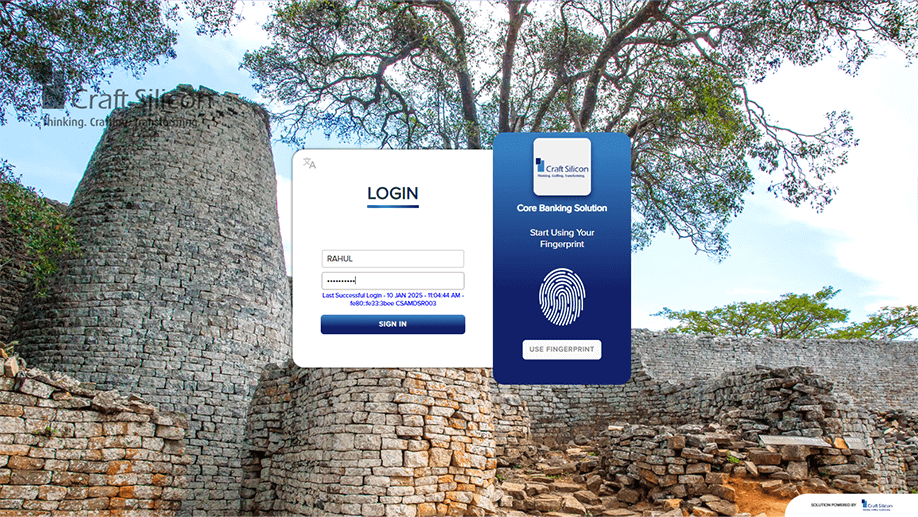

- Biometric Login: Advanced authentication to secure access.

- Multi-Factor Authentication: Strengthens security with multiple verification layers.

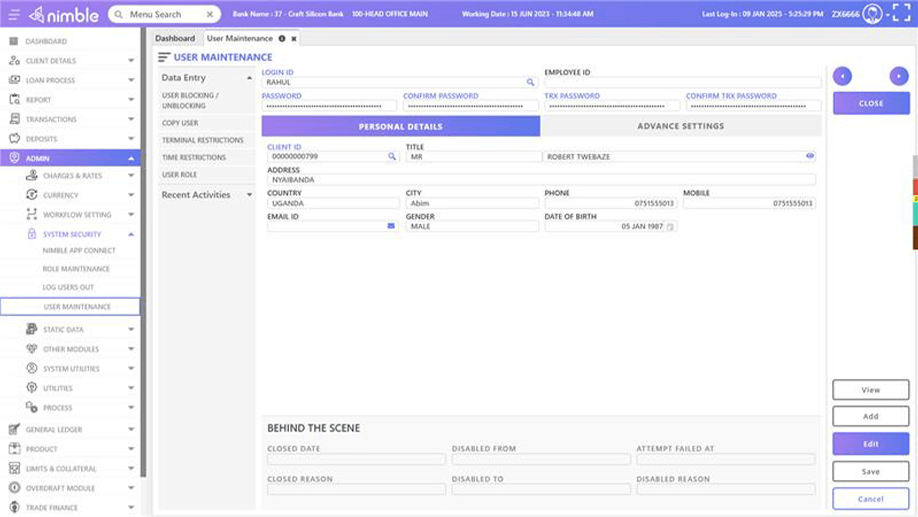

- Role-Based Access Control: Manages user rights and permissions effectively.

- Encoded Tokens: Ensures secure login with hard-to-penetrate authentication tokens.

- Restricted Access: Implements terminal and time-based restrictions for added control.

- Dedicated Authentication Server: Separates authentication processes for increased security and reliability.

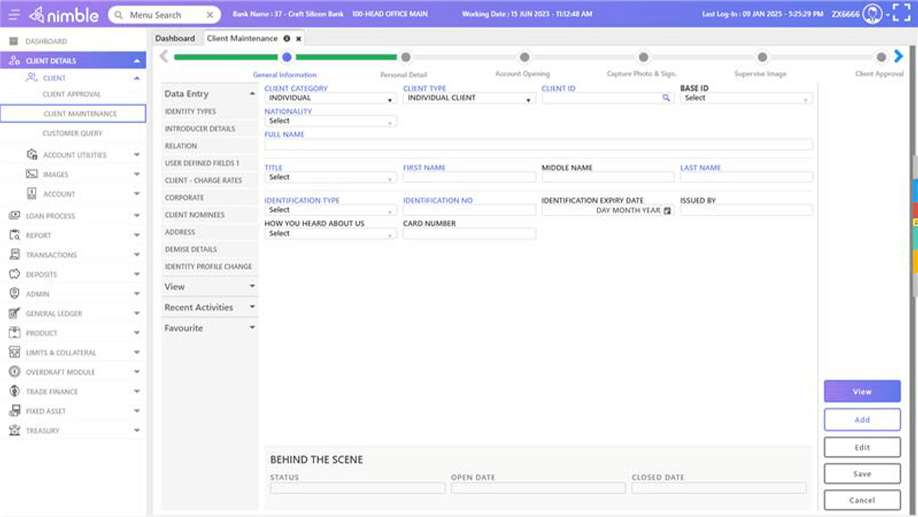

- Standardized UI: Standardized visual design & interaction patterns across all modules.

- Enhanced Usability: Simple yet powerful features to complete tasks & processes.

- Easy Accessibility: User-oriented navigation for intuitive and efficient access to features.

- Smart Page Layouts: Use of smart & purposeful layouts to get things done fast.

- Customer Interactive: Consistent use of design patterns and components to enhance user engagement.

- Streamlined Loan Application & Approval: Simplified process with automated evaluation using built-in algorithms and rules.

- Robust Repayment Tracking: Accurate monitoring and updates on loan repayments and statuses.

- Seamless Integration: Integrates effortlessly with external systems like accounting software, credit bureaus, and payment gateways.

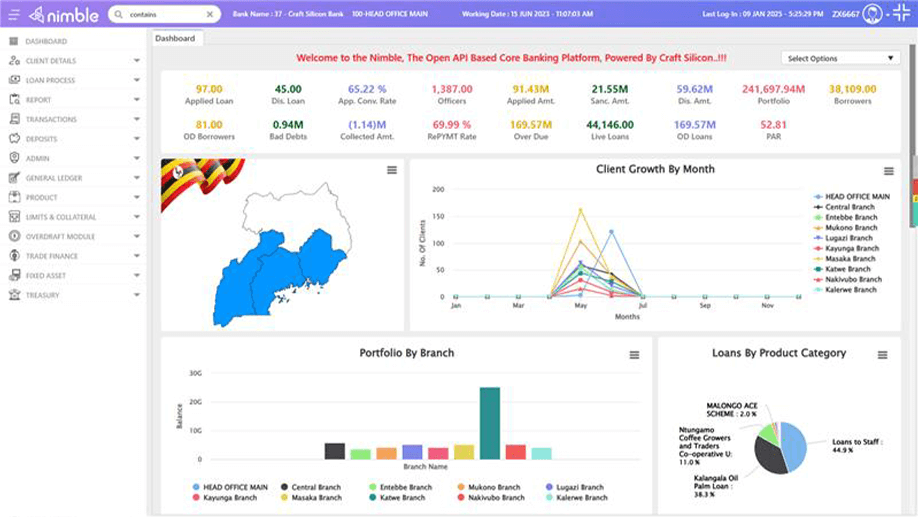

- Real-Time Data Access: Instant access to loan applications, statuses, and repayment schedules.

- Secure Data Exchange: Advanced security with authentication and encryption for safe API communication.

- Comprehensive Reporting: In-depth analytics to track loan performance and profitability.

key benefits

Technology that drives to the winning transformation

Seamless Third-Party Integration: The Open API framework allows for effortless connections with external services.

Interoperability: Facilitates collaboration with fintechs and other partners to expand service offerings.

Robust Security Architecture: Includes biometric login, multi-factor authentication, and encrypted data to safeguard sensitive information.

Audit Trails: Comprehensive tracking of all transactions ensures transparency and compliance.

Intuitive Design: Enhances user experience with a modern, responsive interface.

Personalized Access Control: Role-based management tailors user access to specific needs.

Modular Design: Easily adapts to the evolving needs of financial institutions.

Customizable Solutions: Tailor-made features cater to the specific requirements of banks and their clients.

BR.Net is an agile, componentized business solution, addressing the needs of:

- Banks,

- SFBs,

- NBFCs and

- MFIs

It works on a robust technology architecture that supports both SaaS & Modern Enterprise Platform. It drives centralized operations, Supports low-end PCs and mobile phones.

The enterprise-class security ensures seamless integration across industry applications and services.